Enterprise Zone & Tax Credits

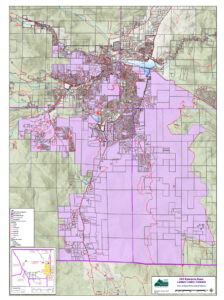

Colorado’s Enterprise Zone Program is designed to spur economic and community development in targeted geographies around the state. Private businesses located within an Enterprise Zone may qualify for incentives related to business investment, company expansion, and/or new business relocation.

The Colorado legislature created the Enterprise Zone Program to encourage development in economically distressed areas of the state. The 16 designated enterprise zones have high unemployment rates, low per capita income, or slow population growth.

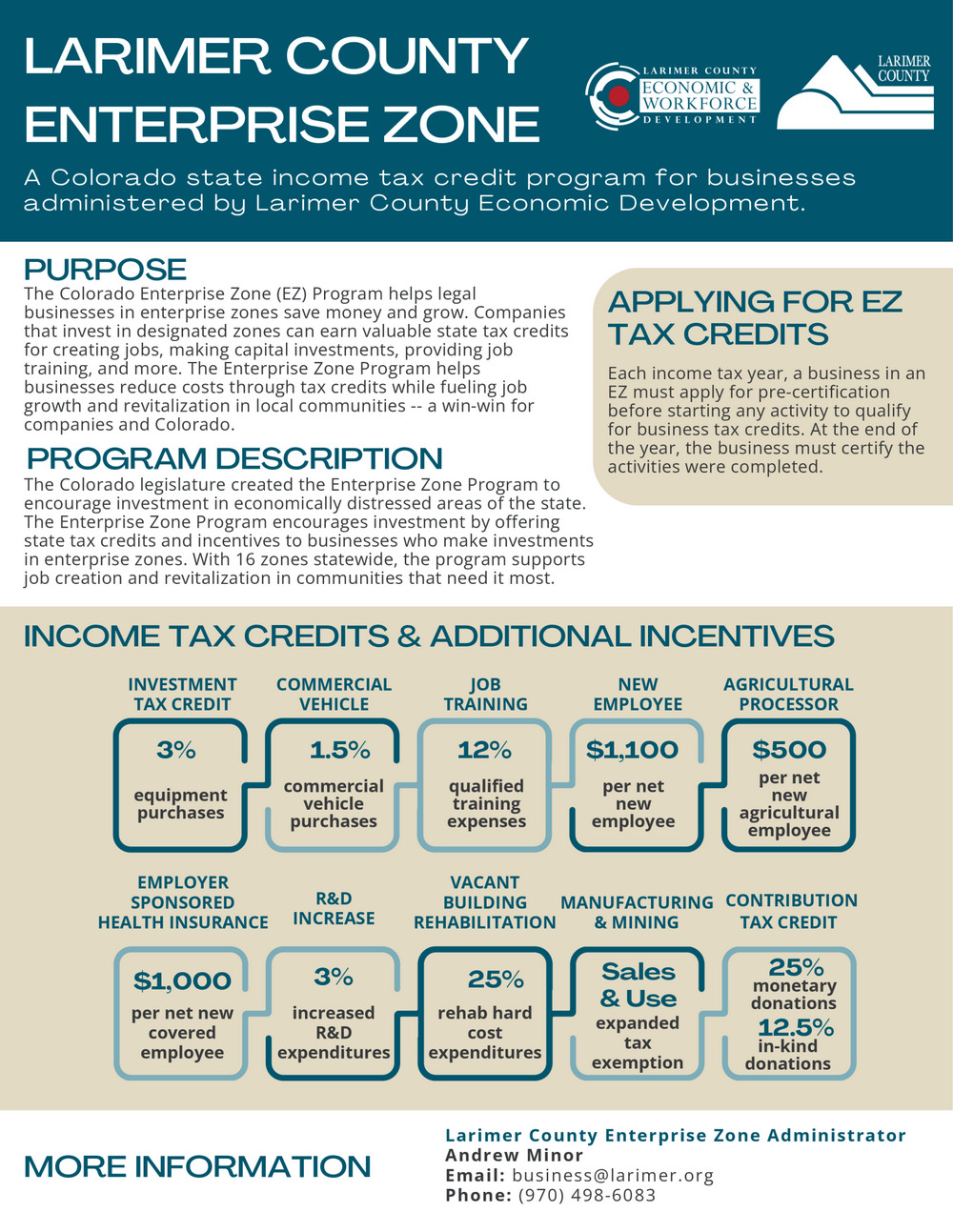

In designated enterprise zones:

- businesses are eligible for state income tax credits and sales and use tax exemptions for specific business investments

- economic development projects form by incentivizing taxpayers to contribute through state income tax credits

- taxpayers who contribute to enterprise zone projects may earn income tax credits

Enterprise zone areas within rural counties that meet additional economic distress criteria receive enhanced rural enterprise zone status. Businesses within enhanced rural enterprise zones earn additional tax credits when adding net new employees.

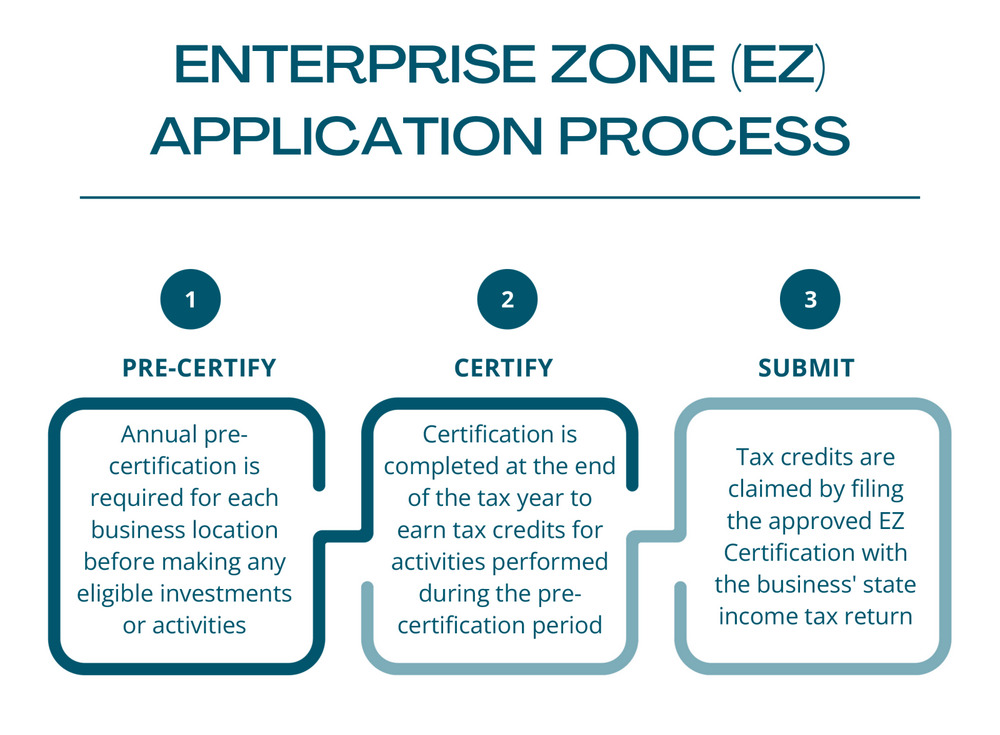

Please note that all businesses must pre-certify with the State prior to performing an activity that will earn an Enterprise Zone tax credit.